Fiscal Policy

A note to Edmontonians: this is one of the transition memos that I developed for the next Council. In making them public, I hope that they are of use to candidates and voters alike and contribute to a productive discussion about Edmonton’s future.

“You need a funding source.”

Those are words I’ve said many times while chairing City Council meetings, not as a piece of political rhetoric, but an operational fact. As Council, you can’t do much without money, and as much as it seems obvious, that money needs to come from somewhere — the tax levy, offsetting cuts to other areas, or user fees.

I call it the “law of conservation of money and service” — and it is a lesson that will save the new Council a lot of time as they hit the ground running. You can’t add service without money, and you can’t find new money without altering service or levying taxes. Like in physics, real-world variables can chip away at the equation’s efficiency, and a big part of City Council’s job is to make sure the City keeps getting more efficient so we can maximize the services Edmontonians get for their money. But even when you are harvesting efficiencies, you need to wring them first before reallocating.

That can seem like a value statement, but where values actually come into play is when Council decides how to use scarce resources, and how much to ask of ratepayers. Without budget decisions to back it up, those aspirations don’t become real.

This is why Council should have a clear understanding of the City’s fiscal situation, and the opportunities and challenges that lie ahead. I am not aiming to summarize the City budget, but instead provide an overall look at the fiscal context facing Council. Overall, the City has made good progress on shoring up our fiscal position in challenging economic circumstances. However, as the next Council pursues its agenda and considers new spending, it will be constrained by external pressures such as the pandemic, the climate crisis and a challenging intergovernmental situation.

Fiscal context

Fiscal stabilization

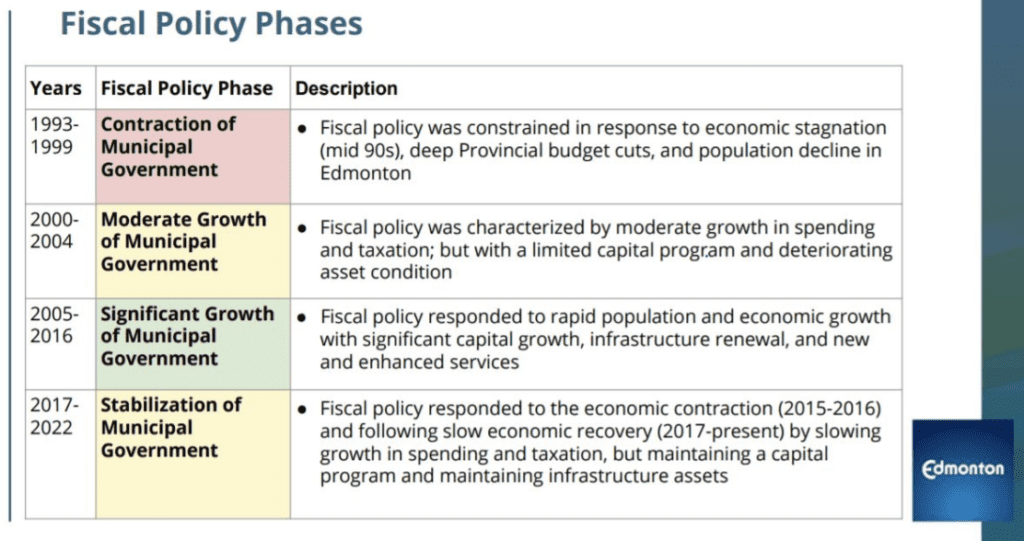

One of the best ways to understand today’s fiscal landscape — and the different fiscal pathways available to the next Council — is to look at the different approaches taken by the City over the past 20 years. The following charts were helpfully put together by City Administration in early 2020, and I think that they are very insightful in understanding the past and the present.

In recent years, Council has taken an overall fiscal policy of stabilization. Inflation-adjusted tax revenues per capita have levelled off, translating into low increases to the property tax levy that are in the realm of general inflation. This chart was produced before the recent 0% tax increases of the pandemic, so you would see a real downward dip in the blue line if this were updated.

Stabilization is a budget choice to instill a greater level of fiscal discipline, reflecting Council’s priority on tracking more sluggish economic growth while avoiding significant cuts to City services Edmontonians rely on. While new spending per capita has been limited, Council has continued to maintain a strong infrastructure maintenance program — cuts to maintenance are the essence of short-termism.

Past fiscal policies also contribute to the decision-making context — the choices in the 1990s to avoid tax increases while suffering provincial cuts created the conditions where we needed to catch up on infrastructure during the 2005-2016 growth phase. This infrastructure deficit from the 90s, combined with boomtime wage pressure and significant population growth drove higher tax increases during that period. As the next Council faces its own challenges to contend with, it will have to decide whether to continue with the stabilization policy or to take a different fiscal route.

Debt

The use of smart debt for infrastructure is an important tool in ensuring the long-term success and financial viability of a growing city like Edmonton. Borrowing for a capital project can help us build an asset when it is needed and when federal and provincial partner funding is on the table. It can also spread the cost of an asset more equitably among those who benefit from it.

Council uses the Debt Management Fiscal Policy to ensure that debt is used appropriately and kept under a self-imposed limit stricter than the requirements of the Municipal Government Act. While the Council’s use of debt has increased as we have started building a city for the future during the ‘significant growth’ and ‘stabilization’ phases of fiscal policy, our credit rating remains strong at ‘AA’ (for context, the Government of Alberta sits at ‘A’).

Going forward, debt remains a tool that Council can use judiciously. One key advantage is that the City is able to lock in an interest rate for the entire duration of the term, meaning that we can currently take advantage of lower interest rates to continue with city-building investments that also provide immediate economic stimulus. In the coming years, some higher-interest debt related to the previous Capital Line LRT expansion will be coming off the books, freeing up some debt room that the City can take advantage of at a lower interest rate.

Efficiencies

No matter how much money Council chooses to raise in property tax revenue, we can all agree that we need to spend it wisely, that we need to make efficient use of Edmontonians’ funds. I believe that is always a focus for the City, but Council has made it a higher priority in recent years in order to continue adapting to new service demands while moderating tax increases.

Between 2014 and 2018, Council directed Administration to find annual savings equivalent to 2% of the annual tax levy through innovation and continuous improvement, leading to over $127 million in efficiencies and cost avoidances. Since 2018, the City has been reviewing all services for efficiency, effectiveness, and relevance through the Program and Service Review, which has led to about $30 million in further savings while also providing improvements to safety and reductions in red tape.

Outside of these processes, the City had to quickly find about $25 million in cost savings in December 2019 to adapt to unexpected provincial cuts (more on that later!) without impacting the tax levy. In December 2020, Council approved about $56.5 million in further budget reductions, including many efficiencies but also some service level reductions and workforce strategies.

Taking all those cost-saving measures together, that tally works out to about $238 million in savings within the budget. That’s equivalent to about 13% of the tax levy. These efficiencies have given the current Council some room to operate without the kind of larger tax increases from the last decade. Going forward, the next Council may have to dig deeper to find additional savings to decrease the tax levy or offset new spending.

Capital project management

Another key aspect of fiscal prudence is properly managing the capital budget. During the 2013-2017 Council term, we revamped the project management model to improve the design and delivery process and avoid cost overruns for major projects. The results have been encouraging: when looking at the 72 ‘significant’ projects with price tags of $20 million or more, we are 99% on-budget (projects are weighted by their budget in this calculation).

By combining an aggressive cost-saving program with an overall policy of fiscal stabilization and properly taking care of infrastructure, my view is that this past Council has been as fiscally responsible as any in previous decades.

Challenges

However, that doesn’t mean that there aren’t significant challenges that Council will have to face as it determines its fiscal policy. One frame on all these challenges is the overall economic picture. Edmontonians likely won’t tolerate tax increases like when we were the fastest growing city in the country, digging our way out of an infrastructure deficit from the ‘90s in an environment of rapidly rising costs in competition with resource booms.

Challenge: COVID-19 impacts

Like it has for many of Edmonton’s households and businesses, the COVID-19 pandemic continues to have a sizable impact on City finances. Lowered revenue from transit and City facilities, coupled with increased costs related to pandemic response, will continue to have an effect for years to come.

The City has adjusted nimbly to this point, adopting temporary cost-saving measures to absorb pandemic-related financial impacts in both 2020 and 2021 without passing additional costs on to the taxpayer. One might remember the longer grass in 2020, for example. We also benefited from some relief funding from federal and provincial governments in 2020, which essentially allowed the City to carry over the 2020 savings to help address the $150 million shortfall in 2021.

Council will have to continue to address COVID impacts for at least another couple of years. Transit ridership is not expected to return to pre-pandemic levels until 2024. This year, the City has planned to absorb an estimated $63 million hit to transit fare revenue without cutting service. While we all hope the impact is lower in future years as COVID enters an endemic stage, we know that ridership will be slow to recover and that the financial pressure on the City to maintain the same level of service with lower fare revenue will continue. We expect a $30 million shortfall in 2022 and $20 million in 2023 for transit alone.

The City’s latest analysis projects an overall 2022 COVID-related shortfall of $75 million. Finding the money to bridge that gap will not be easy, and should ideally involve continued federal and provincial advocacy in addition to strong fiscal discipline at City Hall.

Challenge: climate crisis

Leaving climate risks unaddressed for too long is already costing us all more in disaster disruption and higher insurance premiums. Edmonton’s Energy Transition Strategy, updated earlier this year, calls for about $100 million in annual municipal investment as part of the response to the climate crisis. Cities can play an important role in the fight against climate change, and we need to adapt to stay economically relevant.

The City is still working on details, but it will fall to the next Council to begin to ratchet up implementation of the Energy Transition Strategy. The investment will need to be paid for either out of additional revenues or service reductions, posing a threat for any future discussions around tax decreases or substantial service increases in other areas. Many of these investments are in our buildings and fleets and do have an efficiency payback over time, but will need financing nonetheless.

In my view, this means that any new City spending will need to lean heavily towards doing our part to combat the climate crisis, leaving even less for other priorities. To make sure those investments drive the maximum impact, Council will be able to use the new carbon budgeting system currently under development.

There is long-term economic benefit to investing in climate mitigation and working towards a net-zero city, but property tax is not very good at capturing that kind of economic benefit in the same way sales or income taxes are (another argument for modernizing municipal funding tools and making them true partners in driving economic prosperity). In any case, short-term return on investment will be limited. Still, deferring climate action is false economy.

Challenge: police funding formula

This is not a new cost pressure, but it is an issue that Council should be aware of when figuring future tax adjustments.

Council passed the police funding formula policy in 2014, in an effort to allow for predictable funding tied to cost increases instead of a politicized annual budget process. However, as Council pivoted to a policy of fiscal stabilization, this meant that police funding grew at a more rapid rate than other City programs. Although the City dug deep to get to a 0% tax increase for 2021, the police funding formula still required an increase to the overall tax levy, and other City services had to make more cuts to counteract that increase. The decision of the next Council around reviews of the funding mechanism will have an effect on the overall budget and therefore the tax adjustment.

The funding formula also means that police receive a set amount per year for traffic safety from automated enforcement revenues. That number is not subject to the same automatic increase as the general police funding, but in the context of overall declining automated enforcement revenues, it takes up a larger and larger proportion of the available funds, leaving less for the City’s traffic safety program. This in turn puts pressure on the property tax levy to make up the shortfall to traffic safety programs other than police enforcement. Alternatively, Council may choose to reduce the investments in traffic safety that have contributed to a 63% reduction in traffic fatalities since 2015, though that would not be in keeping with our Vision Zero safety objectives.

On a related note — the same trade-off would be present but on a larger scale if Council decided to cancel the automated enforcement program in general. All enforcement revenues are held in a separate reserve to fund policing and traffic safety work. Thus, eliminating photo radar would need to be addressed with either a service cut to traffic safety and policing, a service cut elsewhere to compensate for the lost revenue, or a tax increase. It’s easy to say do away with automated enforcement, but that would defund important policing and safety investments without a properly-costed offset.

Challenge: provincial cuts and dependency

Provincial grant funding has long been an important revenue source for Canadian municipalities, within the context of the limited fiscal tools (ie, property tax) that the provinces themselves have conferred upon municipalities. Municipalities own and maintain most of (>60%) the nation’s infrastructure while collecting at most ten cents of the overall tax dollar — so transfers from other governments are a necessary way to bridge that gap.

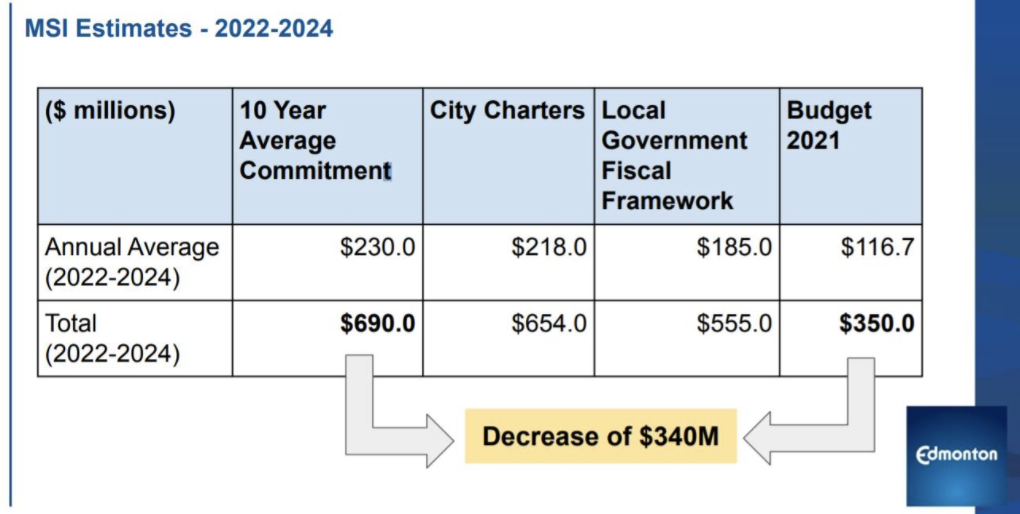

However, with this granting arrangement comes an uncomfortable dependency. Recently-announced provincial cuts to Alberta’s municipalities, especially Edmonton and Calgary, are likely the largest threat to our budget and therefore to the kind of city the next Council wants to build. It is difficult to avoid vulnerability — the City Charter Fiscal Framework was a legislated funding deal, with an explicit commitment in the UCP platform, and it was still repealed and gutted.

Following the unilateral repeal of the City Charter fiscal provision by the Province, infrastructure funding is now set to fall off a cliff for all Alberta municipalities. Over the past 10 years, the Province has committed an average of $230 a year to Municipal Sustainability Funding in Edmonton. Going forward, we are being promised about half of that.

Overall, MSI funding makes up 13.1% of our current capital budget, including 30.8% of renewal projects. These cuts will have an effect, significantly constraining the ability to add new projects to the 2023-2026 capital budget and even threatening the ability to properly maintain and renew existing roads, bridges, sidewalks and facilities. Dealing with provincial cuts that will affect City projects is especially frustrating considering how the City has been forced to step up to pick up the slack on provincial issues such as affordable housing.

Dealing with these cuts will be a challenge on multiple levels. As a budget exercise, Council will need to make some tough choices about what kind of investment it wants to prioritize, and how it can avoid kicking costs down the road in the form of deferred maintenance and renewal. Council will also have to meet these cuts as an intergovernmental challenge and work to find a better arrangement so that Edmonton can continue to provide the level of service that Edmontonians expect, and that will support continued economic growth and financial sustainability.

These issues are not limited to Edmonton or even Alberta. Across Canada, cities are increasingly seen as a threat to the power and authority of provincial governments. This isn’t as much a partisan issue as some would like to believe, but rather an issue of power between the government that has the fiscal and legislative tools and the government that has the problems to solve — and relatively speaking greater institutional credibility from the public.

We can’t continue like this: we need economic security, regional strength and collaboration and we need to work out a new deal with senior orders of government so we can properly build globally-competitive Canadian cities.

Opportunities

Opportunity: following through on the City Plan

Council will have the opportunity to continue the progress we have made on building a more compact, financially efficient city. The City Plan calls for the next one million Edmontonians to be accommodated within our existing boundaries, which will mean upping our density and making the most out of our existing infrastructure instead of continuing to build more and more infrastructure as we sprawl outwards. This is a long-term proposal, with a projected savings of about 8% over the coming decades. However, committing to the City Plan vision through projects like the Zoning Bylaw Renewal can improve the City’s financial position in the short and medium terms as well by driving vibrant urban growth that adds significant value to the City tax base, while avoiding costly sprawl.

City investment also plays a role in the City Plan — continuous austerity will not bring us the prosperous future identified in the vision. There may be opportunities to use smart debt to finance City investments to incentivize vibrant urban development, particularly as some high-interest debt related to the previous expansion of the Capital Line LRT comes off the City’s books in the coming years. The City will also have revenue opportunities from the sale of the remaining suburban developments lands within our borders, which can be directed to the City’s part in the development of the Exhibition Lands and Rossdale.

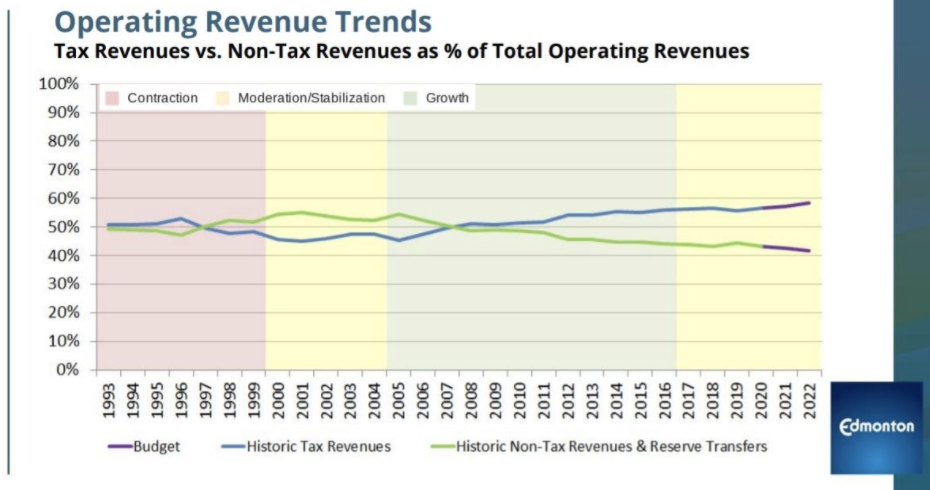

Opportunity: diversifying revenue streams

The next Council will inherit a trend that has continued since 2005: more and more of the City’s budget is funded by property taxes, while proportionally less coming from other sources such as user fees and levies. The City has made some progress on developing a thoughtful approach to using different revenue tools, but the trend has continued nonetheless. The next Council will be in a position to choose how to use different revenue tools to diversify away from property taxes. There is no free money, but looking at a range of tools other than property tax could help allocate costs more fairly.

One key aspect of this work will be the ongoing discussion about how development levies can be deployed fairly to pay for new growth infrastructure. Council approved the first step this summer — levies to pay for a portion of new fire stations — and will have future opportunities to consider levies for different types of growth infrastructure as well. Similar principles can be used on the operating side as well, and Council has approved a Fiscal Policy for Revenue Generation to help guide these discussions.

Opportunity: further cost savings

The City also has a continuing body of work on cost savings that Council will be able to follow through on or modify, as they wish. As part of the strategic response to COVID-19 in summer 2020, City Administration brought forward the Reimagine report — which is itself worth a read for numerous suggestions on how to adapt to constrained fiscal circumstances.

Under the Reimagine Services banner, the City has produced several cost-saving measures that the next Council may be able to benefit from. Some of these proposals have come under fire for various reasons – some of them valid – but they are a worthwhile consideration in light of the economic and fiscal context. The proposals brought forward by Administration earlier this year totalled $16 million, which could be used to reduce the tax levy or be re-allocated to cover emergent costs.

There may also be opportunities to continue right-sizing the organizational structure. After a City Auditor report in 2020 pointed out a large increase in supervisors and management at the City, Council responded by incorporating supervisor reductions into the fall 2020 budget adjustment that got us to a 0% tax increase in 2021. Going forward, Administration has committed to bringing forward further management and supervisory reductions as part of future budget conversations.

Finally, Council should consider the role of newer collective agreements in overall cost containment. Wage settlements are the largest cost driver for the organization, and the kind of mandate Council gives to City negotiators will affect the overall fiscal picture. Proportionately, a 1% cost of living change across civic payroll flows through to a 1% property tax change.

Opportunity: new intergovernmental partnerships

Cities have a lot to offer to federal and provincial governments, and there will be an opportunity post-federal election to bring more investment to Edmonton. We might have to get creative, but building on direct federal partnerships like the Rapid Housing Initiative could be a good way to bring additional investment to Edmonton while helping the federal government achieve its goals.

A big idea

We need to think outside the box to set Edmonton up for success. Here is one idea to consider.

Cities are being squeezed by the pandemic and provincial dependency, and significant cost pressures like the climate crisis. We need to do our part to build a bright economic future, but lack the fiscal tools to capture a return on investment.

It’s time to consider diversified revenue streams to make cities sustainable, ideally with ‘own source’ revenue.

We’ve seen that City Charter legislation can be rolled back and that long-term funding promises from the Province are not reliable, so the only answer is direct access to revenue linked to economic activity in the city. For example, many American cities have direct access to payroll and sales taxes. It would be possible for a shift to occur without raising taxes overall where a visionary provincial or federal government could enter into binding, constitutionally-protected agreements to transfer tax room to municipalities offset by reductions in the current granting schemes. This would require significant federal and provincial cooperation; however, it would be much more difficult for future federal and provincial governments to claw back.

Overall, government would be smaller at the senior level, and the same size at the municipal level, but there would be two main advantages

- Own source revenue can be leveraged by a municipality to cover smart debt for infrastructure (grants cannot), and;

- Cities could get a more direct upside to attracting new jobs or economic activity, creating a much stronger and quicker incentive to compete more aggressively for growth.

- Such approaches could better track growth in the knowledge economy employment (and gig economy employment for that matter) which is increasingly de-linked from taxable non-residential property like factories and office towers.

A jobs or economic output related tax would also deal with a historical issue for Edmonton that many health and education jobs in the city do not contribute directly to the city’s bottom line as colleges and hospitals are property tax exempt — a gap that is even wider if the professor or doctor lives elsewhere in the region and does not pay residential property tax in Edmonton.

Conclusion

Edmonton has made significant progress in getting our own house in order and pursuing a responsible fiscal policy. Still, significant external challenges will constrain future ambitions to either cut taxes or raise services. The central fiscal question facing the next Council will be how to best support Edmontonians now while ensuring the success of future generations. It is a lot to ask given difficult circumstances, but that is the task at hand.

Wishful budget thinking won’t help us meet the challenges ahead — it never has. Neither will austerity, continually cutting our way to prosperity. At the same time, large tax increases like those from 2005-2015 would be out of place with the sluggish economy and the financial realities facing Edmonton’s households and businesses.

Going forward, I am confident that Council can still thread the needle on building a great city for our kids. It will require strong leadership and tough decisions, and a willingness to look outside of the status quo for solutions. It won’t be easy — indeed, the path of least resistance could be the one that leads nowhere. But it can be done, and Edmonton deserves nothing less.

Further considerations

- How can the next Council contribute to Edmonton’s fiscal sustainability?

- What are your top priorities (if any) for new spending? What are your top priorities (if any) for reductions?

- What do you view as the main fiscal challenges and opportunities facing the City?

Further reading

- City of Edmonton Operating and Capital Budgets

- Operating and Capital Financial Updates (June 30, 2021)

- User Fees White Paper

- Energy Transition Strategy

- Don Iveson: City Charters Fiscal Framework blog

Read other transition memos