Regional Economic Development

A note to Edmontonians: this is one of the transition memos that I developed for the next Council. In making them public, I hope that they are of use to candidates and voters alike. Whether or not you agree with all of the content, I hope these briefs contribute to a productive discussion about Edmonton’s future.

As goes the Edmonton Metro Region, so goes Edmonton; and as goes Edmonton, so goes Edmonton Metro. This is the ‘metropolitan mindset’ we’ve worked to build among municipal neighbours and key economic development players. The minute we get divided, or forget the metro mindset, we lose the focus we need to effectively leverage and promote the strengths of the whole region.

It will be essential for Edmonton and for our Metro Region that this work continues beyond this election. In fact, I believe our economic future and our ability as a region to compete effectively, to moderate tax levels, and to maintain our high standard of services and quality of life depends on this kind of cooperative leadership among Edmonton and surrounding municipalities. Working with our neighbours is one of the most important things we can do as City Council to ensure Edmonton’s economic future is bright.

There are two degrees of competition we need to concern ourselves with: local (friendly, hopefully) and global (merciless). Local competition on service levels and taxes, regulatory regimes, permit timeliness, land readiness — these help us all stay nimble. But the friendly competition for where an investment choses to locate in our region is only an issue if we attract the investment to our region in the first place. Thus, our real and fierce competition is other city regions, which is why we need to work together at the metro scale to strengthen our brand and in turn attract and retain jobs and investment.

Back in the 2013-2017 term, many regional mayors were frustrated with slow progress on regional collaboration. The then-24-member Capital Region Board lacked common vision and was stuck in the muck. So a smaller group of counties and cities including Edmonton came together as the Metro Mayors Alliance and assembled a blue ribbon panel charged with considering pathways and priorities for regional collaboration and making strategic recommendations to the mayors. The panel’s 2016 report “Be Ready or Be Left Behind” made crisp clear recommendations:

- A robust regional growth plan and accountability system to optimize efficiency of infrastructure and services in the region;

- An integrated regional transit system to support efficiency and improved labour mobility;

- An unified approach to regional economic development, including brand and investment attraction;

- A way of incenting and rewarding cooperation through Shared Investment for Shared Benefit.

The recommendations align with best practices from American city regions that demonstrate high levels of collaboration: Denver and Minneapolis stand out in particular. Those regions have robust collaboration on transit and infrastructure, economic development, and cost and/or revenue sharing. Again, these are examples of our real competition. And these powerful cities have a generation of working together under their belt, while we are late to the game. Fortunately, among Canadian comparators we are leading on metropolitan collaboration.

Why

Many many studies have been conducted over the years about how to optimize our regional system, but the one that set the stage was conducted in the 1950s (the McNally Report) on what to do with both of Alberta’s big cities. Full amalgamation was recommended, and in the 1960s Calgary was consolidated with its surrounding suburbs into a ‘unicity’, Edmonton was only partially consolidated (this is when Beverly and Jasper Place were absorbed, for example) while the outer suburbs of St. Albert and Strathcona Park, as well as the industrial parks and refineries, were kept distinct.

Our region has been beset by long periods of conflict and division for most of the time since McNally; while in contrast, more substantial consolidation helped unify Calgary’s political influence and strategic economic focus and brand coherence. Fast forward to now, both cities exist in complex metropolitan contexts, and I would argue Edmonton Metro is arguably the higher functioning regional system. This cooperative culture, as well as the robust decision making structures now in place with the Edmonton Metropolitan Region Board, can be a strategic advantage for the region if properly leveraged. The systems are robust and while they are far from perfect, the time for tweaking the mechanisms, membership or voting structure is over. It’s time to use the tools for the greater good.

Regional diplomacy consumes a huge amount of a Mayor’s time, and requires a lot of work and engagement among municipal staff across the region. So it requires commitment to make it work. Indeed, people still ask whether it would all be simpler if our region was consolidated, and why wasn’t Edmonton pushing for that? Firstly, that decision is ultimately in the hands of the Government of Alberta, not the City of Edmonton; but more to the point, The Be Ready or Be Left Behind report noted that while there are obvious benefits to mergers, they can take a generation or more to shake out given all the friction inherent in consolidation. Working together cooperatively, on the other hand, can achieve many of the same benefits much sooner, just as we are poised to do with the regional transit commission, for example.

Still, there remain still some real equity issues among regional municipalities and within the Alberta context. For example, the load Edmonton bears in the cost of policing Northern Alberta’s urban core is spread over 70% of taxpayers in our region of 1.4 million. The load Calgary bears in policing Southern Alberta’s urban core is spread over 85% of the taxpayers of their much more centralized metro region. (By the way, provincial grants for policing don’t factor in these disparities.) Similarly on affordable housing issues, major roadway issues, major public transit infrastructure, major regional amenities like the Valley Zoo and Telus World of Science, the loads on Edmonton as the Centre City to sustain regional backbone infrastructure are not shared or spread among as broad a regional catchment. These disparities are a significant contributing factor to taxation rates in the city relative to surrounding communities in our region who do not bear such costs. We do not have a fix for that, and I’ve found it’s generally unproductive to try to remedy historic inequities on those issues, but there are substantial opportunities to share costs and revenues differently going forward, and opportunities to merge specific services to realize efficiencies and widen out the contributing tax base.

Progress

Regional ‘Edmonton Metro’ brand

We succeeded in convincing our neighbours to align to Edmonton Metropolitan Region, or Edmonton Metro for short. Rallying behind the Edmonton brand is an example of the growing Metropolitan Mindset at work. The Region was officially recognized as Edmonton Metropolitan Region when the province updated the regional board’s regulation in 2017. Edmonton Global also uses the airport code YEG in its regional branding to describe the region as Young, Educated and Growing, which are key differentiators for our region in Canada. We do not use ‘Capital Region’ anymore, as there are dozens of other ‘capital regions’ in the world; though unfortunately some regional institutions and provincial voices continue to use the outdated label.

Edmonton Global was founded by 15 municipalities uniting to promote our region to global investors. This Foreign Direct Investment (or ‘FDI’) function previously resided with Edmonton Economic Development Corporation, however it was transferred to Global to sell the whole suite of regional assets on the entire region’s behalf. Its primary mission is to bring investment to the region, and then to work with local economic development officers to help land the investment in the most appropriate municipality. They work closely with Edmonton International Airport and Alberta’s Industrial Heartland Association to attract logistics and petrochemical investments respectively. Edmonton Global played a key role in forming the Edmonton Region Hydrogen Hub and the $1.3B Air Products net-zero hydrogen plant announcement this spring, as well as the Polykar facility attraction.

Restructuring of economic development functions

Spinning off Edmonton Global, along with feedback from innovators and entrepreneurs, ultimately led to further restructuring of EEDC:

- Innovate Edmonton spun off: we heard a strong desire from the startup and tech communities of the need for a standalone agency by and for innovators to support the growth of these promising sectors in our City. The agency is now stood up, carrying on the work of Startup Edmonton and previous programs, with dedicated ongoing funding from City Council to provide programs and attract accelerators and more investment in partnership with entrepreneurs.

- Explore Edmonton now has clarity and focus to lead tourism and venue management, strengthened by the consolidation of Northlands.

- Concierge service for business: certain remaining client-supporting and business retention functions were consolidated with the City of Edmonton itself to provide in-house service to investors and to finesse the permitting process.

Specific sector initiatives

Alberta’s Industrial Heartland Association: formed 20 years ago to attract more petrochemical investment in the Northeast, AIHA helps promote the critical mass of industry capacity, salt dome geology for storage, low cost feedstocks and key infrastructure including the Alberta Carbon Trunk Line. The group is comprised of five municipalities including Edmonton, Fort Saskatchewan, Strathcona County, Sturgeon County & Lamont County, along with a number of associate members. As industrial tax revenues within the Heartland area grow a portion are contributed to the Association to support its work — an early example of Shared Investment for Shared Benefit in the region. This cluster of energy and pet chem expertise is world scale, and includes industry leadership on energy transition like Shell Quest, part of the most energy efficient fuel refinery in the world. We are energy problem solvers here, and that gives us key relevance as the world accelerates transition to net zero carbon future.

Edmonton Region Hydrogen Hub: transitioning to a net zero carbon future will involve multiple clean energy solutions. Electrification doesn’t work well for long haul trucking, shipping and some kinds of heating needs, and hydrogen represents a very important emerging transportation and heating fuel on the path to net zero. Formed in partnership with Alberta’s Industrial Heartland Association’s five mayors and the chiefs of Alexander First Nation and Enoch First Nation, along with Edmonton Global, the Transition Accelerator and the Government of Canada, this initiative is leveraging the regional assets like Carbon Capture Utilization and Storage and low cost feedstocks to build a global scale net-zero blue hydrogen hub in our region. The Hub is working to stimulate and organize demand for hydrogen in our region to help justify industry investments in growing supply. Air Products’ announcement this spring of a $1.3B net-zero hydrogen plant in Edmonton’s Aurum Energy Park is just the start: that plant has expansion potential to double or triple, and several more multi-billion dollar hydrogen projects are under development. The City is helping with testing of hydrogen fuel cell transit buses starting in 2022 as part of this initiative.

Edmonton Screen Industries Office: formed to support our screen content industries, from our strength in gaming to depth in documentaries, and from traditional film and TV to augmented reality. Exponentially more screen content is being generated globally and Edmonton has several niches worth supporting, including skilled storytellers and creators, locations that haven’t become stale and a reliable winter to work with.

Health City: formed in partnership with the biotech industry leaders, Health City seeks to grow Edmonton and Alberta’s bio and health industries. There is a special focus on leveraging synthetic data and clinical trials, supporting our growing strength in medical research, as exemplified by Entos pharmaceuticals DNA-based COVID vaccine and of course Dr. Michael Houghton’s recent nobel prize in virology that has brought attention to the extraordinary work of the Li Ka Shing Institute of Virology at the University of Alberta.

Key federal initiatives

National AI strategy: As one of Canada’s three artificial intelligence centres of excellence, Edmonton has consistently ranked as one of the continent and world’s top-ranked, centred around the University of Alberta and the Alberta Machine Intelligence Institute. Increasingly, other research and post-secondary institutions, as well as the private sector, are growing and building capacity in this sector. However, much work remains — working in conjunction with other orders of government, the private sector, civil society, post-secondary institutions — to create an ecosystem that supports the whole spectrum of the industry, retains graduates, increases deal flow, generates employment, builds critical mass, and diversifies the economy. International competition is intense; our internationally ranked position faces constant pressure from determined and innovative jurisdictions.

BioMed: Canada’s lack of domestic specialized manufacturing capacity has been evident throughout the pandemic. Capitalizing on a 2020 Nobel Prize-winning virologist who is a prominent member of University of Alberta’s faculty and its Covid vaccine research, Edmonton is in a position to propel Canada as a biotechnology world leader, removing the need to depend on foreign suppliers while, at the same time, supporting Canadian manufacturing and drive Canadian ingenuity. Indeed, Edmonton researchers are currently already in advanced trial stages with promising results thus far. Here lies a competitive opportunity to make Edmonton a biomed hub and collaborate with the private sector and other orders of government to invest in and stimulate the full spectrum of research, testing and manufacturing.

Trade Corridors: At the crossroads of international supply chain and logistics corridors, Edmonton’s international airport is a key player in the Edmonton Metro Region’s ongoing economic diversification and prosperity. This reality was especially evident at the height of the pandemic when air freighters transported personal protective equipment from around the globe to Edmonton daily and distributed onwards — a buffer against decimated passenger traffic when commercial travel was essentially grounded. Complementing our region’s strategically located rail and road networks, Edmonton’s tremendous value proposition to investors, business and transport is key to the region and country’s competitiveness and growth. By capitalizing on congested and distant US ports of entry and by opening up new investment opportunities in local manufacturing and processing, Edmonton’s cargo play — which would be boosted with a Government of Canada’s market-signalling investment — is a growing and serious contender, linking trade markets and supply chains in North America and Asia.

Hydrogen strategy: The Government of Canada has recognized the Edmonton Metro Region as a catalyst in the country’s energy transition through its Budget 2021 news review of tax measures to incent pioneer investors embarking on carbon-capturing technology in this area. While the recent federal election temporarily suspended the review, we are hopeful that it will result in favourable conditions to enable further investments in an area where the region has a competitive advantage through its massive natural gas deposits.

Edmonton Regional Transit Service Commission: formed this year, and slated to deliver services next year, this effort consolidates several regional transit operations (from Fort Sask to Leduc and Spruce Grove to St Albert) into a single commission that includes Edmonton, and we will roll some of Edmonton Transit’s service hours in to the commission mix. There is considerable efficiency to reducing overlap with key Edmonton routes, and long term inherent efficiency to having fewer agencies in the region — not to mention lower traffic congestion and GHGs from improved transit, and improved labour mobility. Unfortunately Strathcona County opted not to join the commission at this stage, incrementally reducing the efficiency gains to the rest of the region, but it was still well worth proceeding for the rest of us.

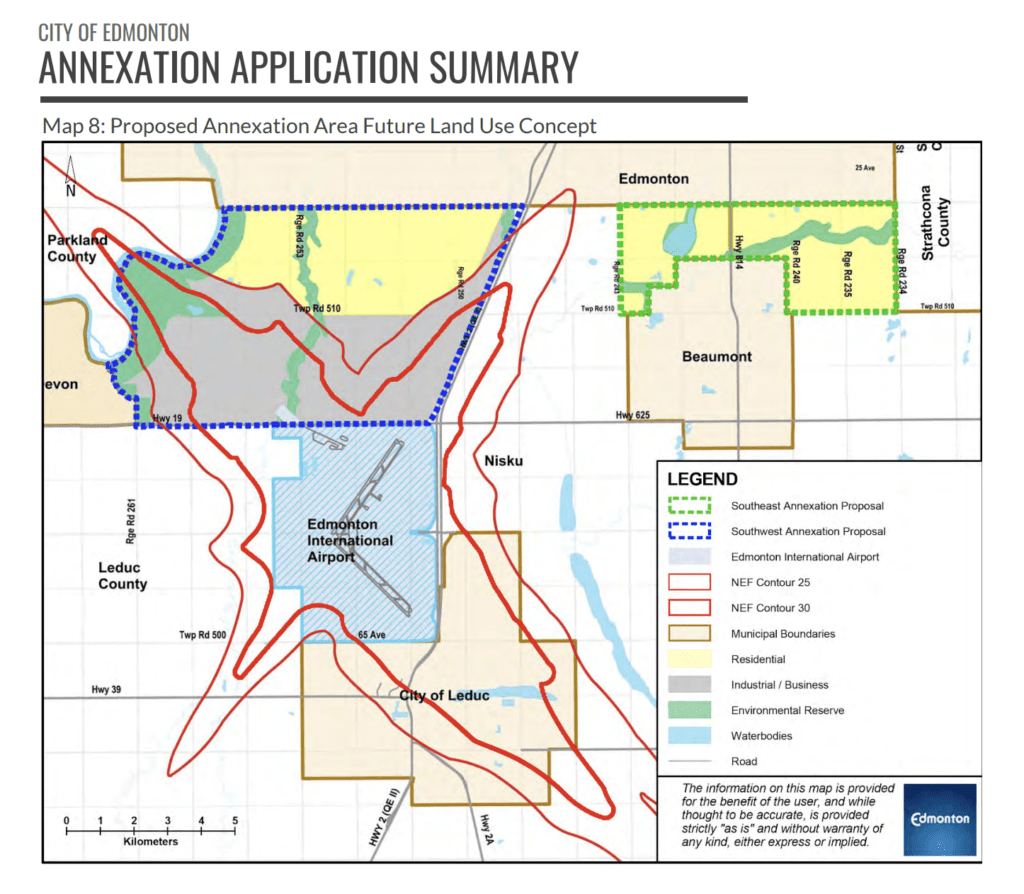

Annexation to the South: The City successfully concluded our annexation negotiations with Leduc County during the past mandate, which gives us a significant development opportunity proximate to Edmonton International Airport. At the density minimums stipulated in both the Growth Plan and the City Plan, there are decades of additional land supply in the growth area.

The majority of the Southwest area along highway 19 is destined for non-residential development given the Airport Vicinity Protection Overlay which limits where housing can be built near airport runway approaches. This represents another strong opportunity for long term non-residential tax base growth in Edmonton, and perhaps in deeper partnership with our neighbours as well.

Opportunities

Opportunity: Collaborative Economic Development

The framework for a joint-venture approach is under development among 13 municipalities in the region for an opt-in approach to advancing non-residential development together. This could include sharing the costs to service an area or project in exchange for a share of the new revenues, and this model could scale from small to very large multi-jurisdiction. This approach can also help ensure that property tax incentives or other incentives are harmonized rather than winding up in a race to the bottom.

Opportunity: property tax incentive

The City has traditionally been unable to offer differential non-residential tax rates for different contexts. Obviously the service levels and infrastructure conditions vary from downtown to an industrial park, and some of our industrial parks were inherited from counties with historically low service standards (i.e. gravel roads, no water or sewer). One of the most glaring competitiveness (and equity) issues arises in a place like Winterburn, where industrial parcels built to old county standards pay city rates, while newer higher standard modern industrial properties in Parkland County pay lower county rates. Arguably the fire and transit service levels are higher in the city, and the labour pool is closer, but the aging gravel roads and inconsistent water infrastructure represent a fairness issue.

A report will come to the new Council examining how a mixture of tax incentive tools and local improvement levies could help these areas be both more competitive and more equitable for their ratepayers, while also inviting new investment to upgrade the infrastructure in legacy rural industrial areas like Winterburn, Maple Ridge and Mistatim. The City could consider these strategies on our own, but the sweet spot would be doing this with rural and urban neighbours and beyond through Collaborative Economic Development to bring different but complementary options to the market with varied service levels priced accordingly.

Opportunity: urban reserves

Council recently adopted an Urban Reserves strategy developed in collaboration with the Confederacy of Treaty Six First Nations. Several neighbouring municipalities participated in the work, and we have indicated openness to working with first nations beyond Treaty Six, particularly Treaty Eight Nations from the North where there are strong and historic ties to Edmonton. This represents a special opportunity for Indigenous investment attraction and job creation. We signed our first memo with Kehewin Cree Nation to advance an Urban Reserve this month.

- Free Trade Zones: EIA is already a free trade zone, but may be worth considering opportunities to expand this idea to other business parks and logistics clusters in the region.

Challenges

The Edmonton Metro Region has come together during challenging times, but the economic and fiscal threats that lie ahead will be a test of our cooperation. As the saying goes, “when the watering hole dries up, the animals start to eye each other as competition.” As I mentioned before, some kinds of competition within the region are helpful, but it is far more important to our overall economic success that we work together to compete against other city-regions in the world.

We won’t be better off going it alone, but that idea might look appealing to some in the region as we move through difficult economic circumstances. It might even look better politically. To avoid this pitfall, it will be key to continue our collaboration and not lose momentum on building regional relationships. City Administration will play a key role in continuity post-election, but the next Council (and the next mayor in particular) should jump into regional collaboration with both feet. You will find willing partners in many of the mayors vying to return.

Some ideas

- Western Canada’s inland logistics park; from Acheson to Hwy 2, from EIA to the Alaska Highway, and from the Yellowhead to Nisku and all parts in between, we can accommodate the world’s movement of goods by air, train and truck. This could be a Collaborative Economic Development co-investment, a free-trade zone, and a place to strategically align on the use of incentives and appropriate municipal service levels (like fire and transit) for different businesses. Perhaps we were thinking too small with the Port Alberta concept, and we didn’t have the mechanisms or the culture to make it a regional play at the time.

- Consider an ESG-focused brand for Edmonton Metro’s investment attraction. Within Alberta’s brand, there is room and need for differentiation for our region — for relevance on climate, reconciliation, inclusive growth, innovative governance. We should own that space and define what’s possible on the prairies.

- Consider inviting nearby First Nations to join Edmonton Global to strengthen partnerships and support economic reconciliation.

- Consider going further on regional integration of services: regional policing, regional waste management integration, deeper cooperation on transit.

Key Partners

- Edmonton Metropolitan Region Board

- AUMA

- Edmonton Global

- Edmonton Region Hydrogen HUB

- Confederacy of Treaty Six First Nations

- Enoch Cree Nation

- Kehewin Cree Nation

Further considerations

- How much priority do you place on working with our neighbours and what mindset would you bring?

Read other transition memos